CRA My Account and CRA My Business: A Complete Guide

Originally Published: Dec 7, 2021

Introduction

If you plan to register a new business, whether a sole proprietorship, business partnership, or incorporation, tax management will be one thing you’ll need to consider. The Canada Revenue Agency (CRA) mandates that all new corporations receive a unique nine-digit Business Number (BN), which becomes their tax identification number. For registered businesses, the BN number is only required if tax accounts are established such as HST or Payroll.

CRA My Account Login

CRA My Account login is available to individuals wishing to register. This can be used for both individual tax for employees and registered businesses.

CRA My Business Account

CRA My Business Account is available to corporations solely. This can also be used for corporate tax items such as corporate tax, payroll and HST or GST.

You will need to provide your Social Insurance Numbers or SIN number along with legal name and date of birth.

After registration, you will need to check the status of your tax account, file returns, and complete other tax-related tasks. Although you can do this manually by printing the forms, filling them in, and sending them, the CRA provides a convenient and fast way to do all this through the CRA My Account and CRA My Business online services.

What are CRA My Account and CRA My Business?

CRA My Account

The CRA Account or CRA My Account must be attached to registered businesses where the tax filing is under the individual tax account. CRA My Account is a fast, convenient, and secure service that lets you view your personal income tax and benefit information. The service makes it easy to manage all your tax affairs online, saving time and resources you would otherwise spend doing everything manually. The service is available 21 hours a day, seven days a week, and can be accessed from any desktop or mobile device with an internet connection.

In addition to convenient availability, CRA My Account offers up-to-the-minute information on transactions and other actions taken on your personal account. That means as soon as you make a payment, you can see the updated information in your account within just a few minutes. Another essential feature of CRA My Account is its security features, including a unique CRA user ID and password that only you have access to.

CRA My Business Account

CRA My Business Account is a similar service to CRA My Account but focused on serving business entities. Business owners (including partners, directors, and officers) can use it to complete wide-ranging tasks across business accounts like payroll, income taxes, excise taxes, excise duties, and GST/HST.

In addition, CRA My Business allows business owners to appoint authorized representatives, including accountants and employees, to access the service through an option called Represent a Client. The service also provides up-to-date information that’s refreshed every few minutes, two-factor account security, and access all week, 24 hours a day.

CRA My Account Features

When you register for CRA My Account, you’ll find several services available that make it easy to complete almost any task you might need to complete.

Here’s what you can do with your CRA My Account:

- Apply for Canada Emergency Response Benefit (CERB)

- Apply for Canada Emergency Student Benefit (CESB)

- View status of tax return

- View detailed status of tax return

- Notification preferences

- View mail

- Request a remittance voucher

- View notice of assessment or reassessment

- View detailed notice of assessment or reassessment

- View RRSP deduction limit and TFSA contribution room

- View detailed RRSP and Tax-Free Savings Account (TFSA)

- View Home Buyers’ Plan and Lifelong Learning Plan

- Pay by pre-authorized debit (create new agreement)

- Pay by pre-authorized debit (manage active agreements, view inactive agreements)

- Arrange my direct deposit (start, update, stop)

- View carryover amounts

- View tax information slips

- View Proof of income statement

- View disability tax credit

- View account balance and statement of account

- Change my return

- Address and telephone numbers (view, update)

- Apply for child benefits

- Benefits and credits overview

- View Canada Child Benefit

- View GST/HST credit

- View Universal Child Care Benefit

- View and update children in my care

- View Working Income Tax Benefit advance payments

- Submit documents

- View authorized representative

- Authorize representative

- Register formal dispute

- View installments

- Change marital status

- Personal Identification Number (PIN)

- Online preferences

- Request relief of penalties and interest

- Open a non-resident account

- Audit enquiries

- File a GST/HST rebate

- Request a CPP/EI ruling

- Canada Workers benefit advance payments application

- Uncashed cheques

- Apply for a Trust Account Number

NOTE: Some features listed above might not be available or only offer limited information if you do not have a security code (more on this later).

CRA My Business Features

CRA My Business has an even more comprehensive list of features and functionalities covering everything from basic settings like notification settings and managing your phone number to handling corporate income tax and excise duty.

Here’s a brief list of some of the features of CRA My Business:

- Account management:

- Manage addresses

- Manage owner phone number

- Manage notification preferences

- Manage direct deposit

- Manage authorized representatives

- Manage business number(s) in your profile

- Manage program account name

- Manage language preference

- Modify CRA security options

- Manage operating names

- GST/HST

- File a return

- View expected and filed returns

- Adjust a return

- File a rebate

- View rebate status

- Adjust a PSB rebate

- File an election

- View elections

- View and pay account balance

- Register a formal dispute (Notice of Objection)

- Payroll

- File a return

- View return details

- Provide a nil remittance

- Respond to notices

- PIER overview

- Request to close payroll account

- View and pay account balance

- View remitting requirements

- Register a formal dispute (Appeal)

- Request a payment search

- Corporate Income Tax

- Transmit a return

- View return status

- View return balances

- View and pay account balance

- View special elections and returns (SER)

- Register a formal dispute (Notice of Objection)

- View direct deposit transactions

- Calculate instalment payments

- Enquiries service

- Request to close corporation income tax account

Other services covered include:

- Excise duty

- Excise tax

- Excise tax on insurance premiums

- Air travellers security charge

- Fuel charge

- Registered charity

- Information returns

- TFSA

- Partnerships

- Contract payments

These services are available to business owners (including partners, directors, and officers) and employees or authorized representatives. For example, when you hire an accountant, you can give them access to your account through the ‘Represent a Client’ portal to administer your account without providing access to profile settings.

How to Register for CRA My Account

Registering for a CRA My Account for individuals is easy and fast.

Here are the steps to follow:

- Enter your personal information, including your social insurance number, date of birth, current postal code or ZIP code and an amount you entered on one of your income tax and benefit returns. (Have a copy of your returns ready because a return for one of these two years must have been filed and assessed.)

- Create your CRA user ID and password.

- Create your security questions and answers.

At this point, your account will be created, and you will have limited access to CRA My Account features. To unlock all features, here’s what to do next:

- Go to My Account for Individuals and sign in using the CRA user ID and password you created in step two above.

- When prompted, enter your CRA security code.

That’s it. You now have full access to CRA My Account features.

In addition, CRA also provides a feature called ‘Sign-in Partner,’ which allows you to sign in with a username and password you already use with one of CRA’s partners (e.g., your bank).

Click this link for more information on Sign-in Partners

How to Register for CRA My Business

If you’d like to register for a CRA My Business account, you can do so by following these steps:

- Provide personal information, including your social insurance number, date of birth, current postal code or ZIP code and an amount you entered on one of your income tax and benefit returns. (Have a copy of your returns ready because a return for one of these two years must have been filed and assessed.)

- Create a CRA user ID and password.

- Create your security questions and answers.

- Enter your business number.

Once complete, you can go back to My Business Account and use the login credentials you created above to sign in. You’ll be prompted for your CRA security code, so keep it handy. You’ll also see a ‘Sign-in Partner’ login option for CRA My Business as well.

CRA Mobile Apps: Access CRA Information on the Go

The CRA provides several mobile apps and web-based mobile portals to make it easier to access CRA services.

Here are the apps the CRA currently offers:

My CRA

My CRA mobile app is a web-based mobile-optimized portal that maps onto the CRA My Account service. It has no Android or iOS apps to download and is accessed through this web address. If you have a CRA My Account username and password, you can use them to log in to the My CRA mobile web app.

CRA BizApp

Like the MyCRA app, the CRA BizApp is a mobile-optimized web portal that offers mobile-friendly access to all CRA My Business services. To sign in, use the credentials you created when signing up for CRA My Business. During the login process, you will need to input your CRA security code.

CRA Business Tax Reminders

As the name suggests, this app, available on Android, iOS, and Blackberry, allows a business to set reminders for various important due dates such as tax returns, instalment payments, and remittances. Unlike the other two apps above, this one does not access your CRA account or any of the information in it; it is just a reminder app.

MyBenefits CRA

Another mobile web app, the MyBenefits CRA mobile app, is for anyone receiving benefits. In the app, you can view benefits details like eligibility information and credit payments. You can sign in to the MyBenefits app using your CRA My Account username and password.

CRA My Account and CRA My Business FAQs

No, it is not mandatory to use either CRA My Account or CRA My Business. The CRA provides them as a value-added service to make it easier and more convenient to access CRA services. As such, it is up to each individual whether to use these online services or not.

Yes, CRA My Business is available as long as you have a Business Number, the nine-digit unique identifier. With a Sole Proprietorship, you would need to establish the BN number due to the need to set up other tax accounts such as HST. With an Incorporated company, the BN number is automatic.

Your CRA My Account or My Business credentials can be revoked for several reasons, including suspicious sign-in attempt activity, to keep your account safe. If the account no longer works, try to sign in with Sign-in Partner credentials or create a new CRA My Account or CRA My Business account. If that does not work, contact the CRA here.

If a representative’s authorization does not have an expiry date, you can revoke it using the CRA My Account or CRA My Business services. Your representative can also cancel their approval by logging into Represent a Client and cancelling it. Other ways you can revoke access are by phone or mail.

The CRA Security Code is a one-time password (OTP) that the CRA sends you via email after completing your CRA My Account or CRA My Business registration. It’s usually set to expire within a specific time, so make sure to use it as soon as you receive it.

No, you do not need separate login credentials for each account. You can use your existing credentials to sign in to all CRA online services. However, accessing the CRA My Business account and other online CRA services might require additional information like a business number during the login process.

If you cancel a business, the CRA My Business credentials will still work, although with limited functionality due to the company’s closure. In most cases, you can continue to use your credentials to access other CRA online services, so there is no need to cancel or delete the CRA My Business account credentials. You will need to notify CRA that the business is no longer operational so the tax account can be wound down to deletion.

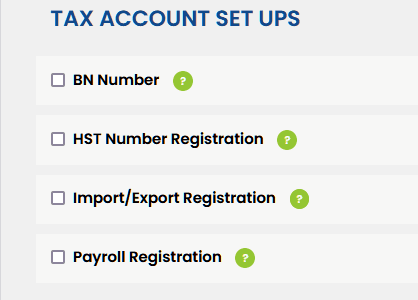

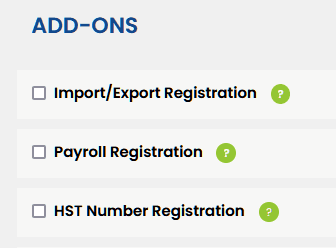

We have been assisting entrepreneurs to register or incorporate businesses since 1992. We had a vast number of clients ask us to also set up tax accounts as they found dealing with CRA difficult and time consuming. We started offering the additional services of setting up the BN (for registered businesses), HST, payroll and import/export licence as an easy add on to setting up the business. It’s as easy as clicking the relevant button or buttons and having our staff take care of the tax account set ups.

This is what options look like for a registered business:

And this is what it looks like for an incorporated business where the BN # has already been selected as part of the incorporation process.

Register BN Number, Tax Accounts

Ontario Business Central has been assisting Entrepreneurs for 30 years to start, change, cancel and search businesses. The tax accounts set up is just another way we help entrepreneurs to get businesses up and going. We are here to assist you not only to register or change your business but to also help you feel confident in setting up relevant tax accounts.

inquiries@ontariobusinesscentral.ca

Toll-Free: 1-800-280-1913

Local: 1-416-599-9009

Fax: 1-866-294-4363

Office Hours: 9:00am – 5:00pm

Monday – Friday E.S.T.

Ontario Business Central Inc. is not a law firm and cannot provide a legal opinion or advice. This information is to assist you in understanding the requirements of registration within the chosen jurisdiction. It is always recommended, when you have legal or accounting questions that you speak to a qualified professional.