Tax, Business and Ontario: A Simplified Guide

Whenever we speak about taxes and operating a business, there is a huge spike in client engagement. This topic seems to be a significant factor for people when either looking at starting a business or filing the first few tax returns.

At Ontario Business Central, we understand the importance of clarity in navigating the tax landscape. This blog post aims to simplify the basics of business taxes in Ontario, providing you with a foundational understanding and resources to guide you further.

Firstly, you’re not alone! As mentioned in the intro, navigating the world of taxes and business can be daunting. It’s a common concern for both aspiring entrepreneurs and seasoned business owners, especially when dealing with the first few tax returns.

Understanding Business Taxes in Ontario:

There are two main types of business structures in Ontario:

- Sole Proprietorships and Partnerships: In these structures, business income is reported on your personal income tax return.

- Corporations: If you operate as a corporation, a separate tax return is filed for the business.

Tax Rates:

- Federal Tax: All businesses in Canada, regardless of location, pay federal income tax. The current federal rate for small businesses (with taxable income below $500,000) is 9%.

- Provincial Tax: In Ontario, there are two provincial tax rates:

- General Rate: The general rate is currently 11.5%.

- Small Business Deduction (SBD): This deduction allows eligible businesses to pay a lower rate of 3.2% on the first $500,000 of their income.

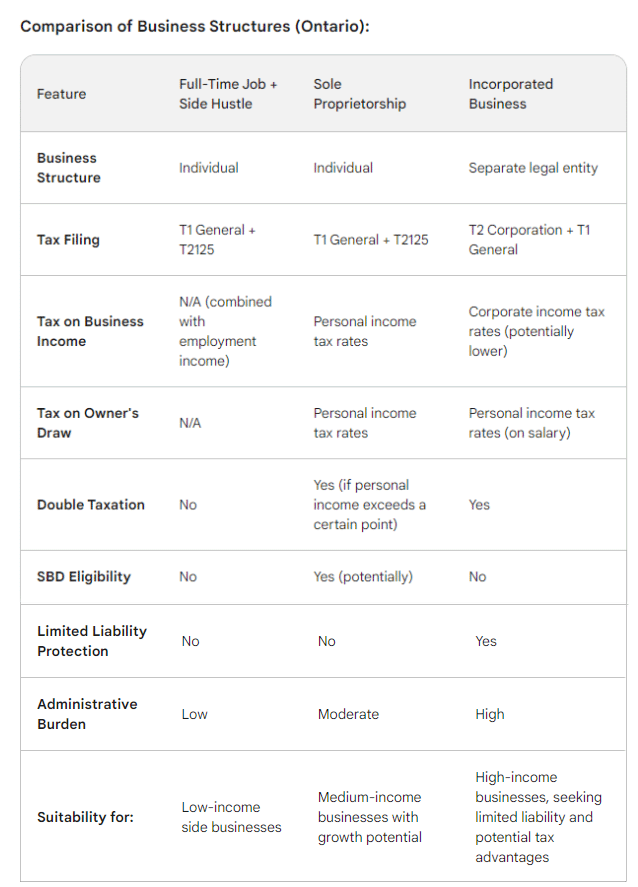

Navigating Different Tax Scenarios

To assist you, here are a few different examples of tax for you under different common scenarios. Those include a person who has a full time job but has a side hustle to boost their overall income, a person who has a registered business as a Sole Proprietorship and lastly, a person who incorporates a business. It is important to mention that these examples are purely to give you a sense of the different tax scenarios and are not intended as tax advice.

Tax Implications For Different Ontario Business Scenarios:

1. Full-Time Job + Side Hustle:

- Individual: Earns $65,000 from full-time job and $10,000 from a side hustle (total income = $75,000).

- Tax Implications:

- This person will pay the regular federal and provincial income tax rates on their total income.

- Overall tax rate: This will vary depending on various factors like deductions and credits, but it’s likely higher than the rate for their main job due to progressive taxation.

- Tax form: They will still file a T1 General Income Tax and Benefit Return and must report the side hustle income on Schedule 1.

- Additionally, this individual will need to use form T2125 to calculate the net income (income minus expenses) from the side hustle and report it on the T1 return.

2. Sole Proprietor (No Employment Income):

- Individual: Earns $65,000 from their business and has $20,000 in expenses (net income = $45,000).

- Tax Implications:

- He or she will pay taxes on their net business income, not the gross revenue.

- He or she are eligible for the Small Business Deduction (SBD), potentially reducing their provincial tax rate to 3.2% on the first $500,000 of income (subject to eligibility criteria).

- Tax form: They will file a T1 General Income Tax and Benefit Return and use form T2125 to report the business income and expenses.

3. Incorporated Business:

- Scenario: A corporation earns $100,000 with $20,000 in expenses (net income = $80,000). The owner draws $65,000 from the business personally.

- Tax Implications:

- The corporation will pay corporate income tax on its net income, likely at a lower rate than the individual tax rate.

- The owner will also pay personal income tax on the salary (draw) they take from the corporation.

This creates a double taxation scenario, where both the corporation and the owner pay taxes on the income.

What is double taxation and does that mean I pay more for the same amount of money?

Double taxation, in the context of business in Ontario, refers to a situation where the same income is taxed twice by different entities. This can occur in two ways:

1. Corporate Income and Dividends:

- Scenario: A corporation earns a profit, then pays corporate income tax on that profit.

- Later, the corporation might distribute a portion of the remaining profit to its shareholders as dividends.

- Double taxation happens because the shareholders pay personal income tax on those dividends, even though the corporation already paid tax on the underlying profits.

2. International Income:

- This scenario involves income earned by a Canadian resident outside of Canada.

- While Canada doesn’t generally tax foreign income, such income might be taxed by the country where it’s earned.

- When the income is brought back to Canada, it could be taxed again in Canada under certain circumstances, potentially leading to double taxation.

What is a Small Business Deduction or SBD and What Type of Business Does it Apply to?

The Small Business Deduction (SBD) is a tax benefit offered by the Canadian government specifically to Canadian-controlled private corporations (CCPCs). It allows these corporations to reduce their federal and provincial corporate income taxes on a portion of their active business income.

Eligibility:

- Business Structure: Must be a CCPC, which means it’s controlled by Canadian residents and doesn’t have a public offering of its shares.

- Business Location: Must be a resident of Canada.

- Business Activities: Must meet certain active business tests demonstrating its primary purpose is carrying on an active business in Canada. This excludes passive income sources like investments.

Benefits:

- Lower Tax Rate: The SBD allows CCPCs to apply a lower tax rate to a portion of their active business income.

- Current Rates:

- Federal: The current federal SBD rate is 9%, significantly lower than the general federal corporate tax rate of 15%.

- Provincial: Some provinces, like Ontario, offer an additional provincial SBD rate. In Ontario, for instance, eligible corporations might benefit from a provincial SBD rate of 3.2% on the first $500,000 of their income (subject to eligibility criteria).

Limitations:

- Applies to a Portion: The SBD only applies to a portion of a corporation’s active business income, not its total income.

- Shared Limit: The business limit (the maximum amount of income eligible for the SBD) is shared among associated corporations, meaning if multiple corporations are linked, they share a single limit.

- Phased Out: The benefit phases out as the corporation’s taxable capital (a measure of its assets) increases, eventually eliminating the SBD entirely at a certain threshold.

Is the small business deduction available for registered businesses such as Sole Proprietorships or General Partnerships?

No, the Small Business Deduction (SBD) is not available for registered businesses such as sole proprietorships or general partnerships. It is exclusively for Canadian-controlled private corporations (CCPCs).

Here’s why:

- Eligibility Requirement: The SBD has a specific eligibility requirement of being a CCPC. Sole proprietorships and general partnerships are not considered corporations, and thus, they cannot qualify for the SBD.

- Structure and Ownership: CCPCs are separate legal entities from their owners, while sole proprietorships and general partnerships are not. This distinction plays a role in the eligibility criteria for the SBD.

Tax Implications for Sole Proprietorships and General Partnerships:

- These business structures report their income on the personal tax return of the owner(s).

- They do not pay separate corporate income tax.

- They may be eligible for other tax benefits specific to their structure, such as the deduction for business use of home office expenses in certain situations.

What is Liability Protection When it Comes to Starting a Corporation Instead of a Registered Business?

When starting a business, one crucial difference between operating as a corporation and a registered business (such as a sole proprietorship or partnership) is liability protection. Here’s a breakdown:

Registered Businesses:

- Personal Liability: In registered businesses like sole proprietorships and partnerships, there is no legal distinction between the business and the owner(s).

- Owner’s Responsibility: This means the owner(s) are personally liable for all of the business’s debts and obligations.

- Example: If your bakery business is sued or incurs significant debt, your personal assets (like your car or house) could be at risk to cover these liabilities.

Corporations:

- Limited Liability: A key benefit of operating as a corporation is limited liability protection.

- Separate Legal Entity: A corporation is a separate legal entity from its owners (shareholders). This means the corporation’s assets and liabilities are separate from the personal assets and liabilities of its shareholders.

- Shareholder Responsibility: In most cases, shareholders are only liable for the amount they invested in the corporation (the value of their shares).

- Example: If your incorporated bakery is sued, your personal assets are generally not at risk to cover the lawsuit, as long as you haven’t personally guaranteed any debts or acted outside the scope of your corporate authority.

Important Points:

- Exceptions to Limited Liability: While limited liability offers significant protection, it’s not absolute. Certain situations, like personal guarantees or engaging in fraudulent activity, can pierce the corporate veil and expose shareholders to personal liability.

- Professional Advice: Consulting with a qualified lawyer and tax professional is crucial to understand the nuances of liability protection and ensure your corporation is properly established and operated to maximize its benefits.

Choosing the Right Business Structure: Navigating Taxes and Liability in Ontario

Understanding the complexities of business taxes and liability can be daunting, especially for new entrepreneurs in Ontario. This blog post aimed to simplify these concepts while providing valuable resources for your specific situation.

Remember: This information is for general understanding only and does not constitute professional tax or legal advice. It’s crucial to consult with qualified professionals like tax advisors and lawyers to tailor guidance to your unique business goals and circumstances.

Ontario Business Central: Your Partner in Business Growth

At Ontario Business Central, we’re dedicated to helping you navigate the exciting journey of starting and growing your business in Ontario. We offer a variety of resources and services to assist you throughout your entrepreneurial journey, including:

- Simplified Business Registration: We offer a user-friendly online platform and helpful resources to streamline your business registration process.

- Tax Information and Assistance: We provide easy-to-understand information on relevant taxes for different business structures, along with links to official resources and tax calculators.

- Expert Guidance: Our team of experienced professionals can answer your questions and guide you towards the most suitable business structure based on your goals.

Success Stories and Community Support:

Beyond technical guidance, we understand the value of learning from real experiences. Our YouTube channel “taking the leap” features testimonials from individuals who have successfully registered their businesses through Ontario Business Central. These stories offer valuable insights and inspiration for aspiring entrepreneurs.

Start Your Entrepreneurial Journey with Confidence:

Don’t let tax and liability concerns hinder your entrepreneurial dreams. We are here to support you every step of the way. Contact Ontario Business Central today to learn more about our services and how we can help your business thrive in Ontario.

inquiries@ontariobusinesscentral.ca

Toll-Free: 1-888-936-2358

Local: 1-416-599-9009

Fax: 1-866-294-4363

Office Hours: 9:00am – 5:00pm

Monday – Friday E.S.T.

Ontario Business Central Inc. is not a law firm and cannot provide a legal opinion or advice. This information is to assist you in understanding the requirements of registration within the chosen jurisdiction. It is always recommended, when you have legal or accounting questions, that you speak to a qualified professional.