Can I Write Off My Car As a Business Expense?

Are you a Canadian business owner wondering if you can write off your car expenses? Well, you’re in luck! The short answer is yes, you can. But let’s dive deeper into the details to ensure you’re maximizing your deductions while staying compliant with the tax laws.

Yes, You Can Write Off Your Car Expenses

First things first, let’s clear the air: as a Canadian business owner, you can indeed write off your car expenses if you use your vehicle for business purposes. Whether you’re shuttling between meetings, making deliveries, or traveling to meet clients, these expenses can add up, and it’s only fair that you get some relief come tax time.

How Much Can You Write Off?

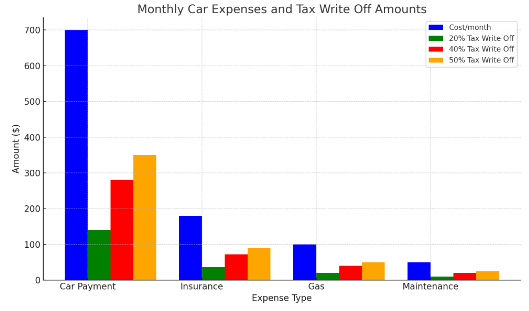

Now, let’s talk numbers. The amount you can write off depends on the nature of your business and how much you use your vehicle for work. Generally, you can deduct the portion of expenses that corresponds to your business usage. For example, if you use your car 50% of the time for business and 50% for personal use, you can deduct 50% of your car expenses.

This chart displays the monthly car expenses for your business , along with the amounts that could be considered for a tax write-off at different business expense ratios (20%, 40% and 50%). Each expense type is shown, including the cost per month and the respective amounts based on the specified percentages for potential tax write-offs. This visual representation helps in understanding how different portions of your car expenses can affect your business’s financial planning and tax deductions.

- 20% off equals $206 to your expenses

- 40% off equals $412 to your expenses

- 50% off equals $515 to your expenses

These figures represent the total amount that could be considered for a tax write-off at each respective business expense ratio , helping to illustrate the potential tax benefits of categorizing a portion of your car expenses as business expenses.

Keeping Track Made Easy

Tracking your mileage and expenses might sound daunting, but fear not! There are plenty of apps out there designed to make your life easier. Apps like QuickBooks Self-Employed, MileIQ, and Everlance allow you to effortlessly track your mileage, categorize expenses, and generate reports come tax time. With just a few taps on your phone, you can stay organized and ensure you’re not missing out on any deductions.

Breakdown of Expenses

Let’s break down the types of expenses you can write off:

- Car Insurance: The premiums you pay to insure your vehicle for business use are deductible. Just make sure to keep records of these payments.

- Gas: Every time you fill up your tank for business purposes, you can deduct the cost. Again, keep those receipts handy!

- Repairs and Maintenance: Whether it’s getting your oil changed or fixing a flat tire, any expenses related to maintaining your vehicle for business use are deductible.

Maximizing Your Deductions

To ensure you’re maximizing your deductions, it’s essential to keep detailed records of your car expenses. This means saving receipts, logging mileage, and staying organized throughout the year. By doing so, you’ll have all the necessary documentation come tax time, making it easier to claim the deductions you’re entitled to.

Registering Your Business

If you haven’t registered your business yet, Ontario Business Central offers a user-friendly platform that guides you through the registration or incorporation process step by step. Whether you’re a seasoned entrepreneur or a first-time business owner, their intuitive interface makes it easy to navigate the complexities of business registration.

Comprehensive Services

From sole proprietorships to corporations, Ontario Business Central provides a wide range of services to meet your business needs. Whether you’re registering a business name, incorporating a company, or filing annual returns, OBC has you covered. Their comprehensive suite of services ensures that you can manage all aspects of your business registration efficiently in one place.

Expert Guidance

Navigating the legal requirements of business registration can be daunting, but with Ontario Business Central, you’re not alone. Their team of experts is dedicated to providing personalized support and guidance throughout the registration process. Whether you have questions about the forms you need to fill out or need assistance with compliance issues, OBC’s knowledgeable staff is there to help.

Cost-Effectiveness

Starting a business involves various expenses, and keeping costs low is crucial, especially in the early stages. Ontario Business Central offers competitive pricing on their services, ensuring that you get exceptional value for your money. By choosing OBC, you can save both time and resources, allowing you to focus on growing your business without breaking the bank.

Time Efficiency

In today’s fast-paced business world, time is of the essence. With Ontario Business Central, you can complete the registration or incorporation process quickly and efficiently, allowing you to get your business up and running without unnecessary delays. Their streamlined procedures and efficient workflows ensure that you can register or incorporate your business with minimal hassle.

inquiries@ontariobusinesscentral.ca

Toll-Free: 1-888-786-6259

Local: 1-416-599-9009

Fax: 1-866-294-4363

Office Hours: 9:00am – 5:00pm

Monday – Friday E.S.T.

Ontario Business Central Inc. is not a law firm and cannot provide a legal opinion or advice. This information is to assist you in understanding the requirements of registration within the chosen jurisdiction. It is always recommended, when you have legal or accounting questions that you speak to a qualified professional.