Mastering Your GST/HST Return: A Comprehensive Guide For Beginners

If your business has been collecting Goods and Services Tax (GST) or Harmonized Sales Tax (HST) from your clients for the products or services rendered, it is crucial to comprehend the process of remitting these taxes to the government.

Submitting a GST/HST return also involves claiming the GST/HST paid on services or supplies necessary for your business operations. Some of these expenses may qualify for an Input Tax Credit (ITC), offering potential tax savings. Explore the Government of Canada’s website for eligibility details regarding ITC savings.

For new business owners, the process of submitting a GST/HST return might appear more complex compared to filing personal income tax. The information required and the submission procedure differ significantly. However, in this guide, we will provide straightforward instructions to help you confidently submit your initial GST/HST return.

Understanding the GST/HST Number

A Goods and Services Tax (GST) number is a distinct tax identification number allocated to your business by the Canada Revenue Agency (CRA). It is also known as your Business Number (BN), which you will use for collecting, reporting, and remitting GST and Harmonized Sales Tax (HST) to the CRA. Additionally, it identifies any other business interactions your company may have with the CRA, such as payroll deductions or corporate income tax.

Your GST/HST number forms a part of your Business Number (BN). Hence, if you haven’t obtained a BN yet, one will be assigned to you upon registration for a GST/HST number.

Filing Your GST/HST Return

The Canada Revenue Agency (CRA) generally expects businesses to submit their GST/HST return annually. While some businesses may have the option to choose more frequent reporting periods, most small enterprises are not obliged to file more than once per year.

Once you’ve registered for your GST/HST number, the CRA will dispatch a personalized GST or HST return form, including the due date for submission.

For sole proprietors, the GST/HST return filing deadline usually coincides with the deadline for personal income tax returns. Your personal income tax return documentation will confirm the GST/HST return submission date.

Corporations often have the same fiscal year-end for both income tax and GST/HST purposes. If a corporation desires a different GST/HST fiscal year-end, CRA’s consent is required. For corporations with a calendar fiscal year-end (e.g., December 31st), the GST/HST return should be filed by June 15th of the subsequent year, with payment due by April 30th of the following year.

Non-calendar fiscal year-end corporations must file their GST/HST return and make payments within three months following their fiscal year-end. While many corporations file annually, others opt for more frequent intervals, such as monthly or quarterly. Additional information on GST/HST return filing deadlines can be found on the Revenue Canada website.

Selecting an Accounting Method

The initial step involves choosing the most suitable accounting method for your specific circumstances. The standard method, where you pay the difference between the collected GST/HST and any earned Input Tax Credits (ITC), is commonly preferred. The CRA also offers two alternative methods: the quick method and the simplified method.

The quick method enables you to calculate the GST or HST owed by multiplying the tax collected on sales using a predetermined “remittance rate.” This approach may be quicker and more straightforward compared to the standard method. However, not all businesses qualify. For instance, accountants, lawyers, and financial advisors cannot use the Quick Method. Refer to the Canadian government’s GST/HST guide, “Who can make this election,” to verify your eligibility.

The simplified method employs a single formula to assist businesses in filing a GST/HST return and claiming the ITC. You only need to sum up your eligible business expenditures, multiply them by a fixed amount based on the tax rate paid, and include any applicable additional amounts. This approach simplifies the process by reducing the need to separately record GST and HST. It is advisable to consult with an accountant to determine the most suitable method for your situation, as they can clarify the implications of one method over another.

Completing Your Return Form

Once you have fulfilled the above requirements, which include registering for your GST or HST number, selecting an accounting method, verifying return deadlines, and potential payments, it is time to complete your actual GST/HST return.

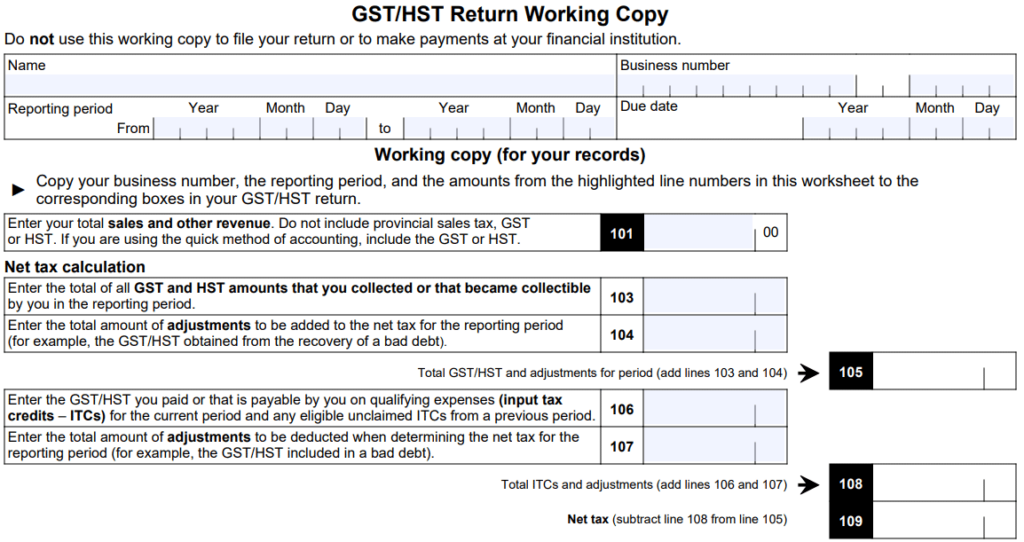

The CRA will provide you with paperwork containing two essential components:

- A “working copy” of your GST/HST return that facilitates calculations (retain for your records).

- The official tax return form containing information to be submitted to the CRA.

On the working copy, you will enter:

- Total sales and other revenue

- Total tax collected

- Total tax paid

- Any additional credits or debits

This form is from

Goods and Services Tax / Harmonized Sales Tax (GST/HST) Return Working Copy (canada.ca)

Following these steps, you can calculate whether you are eligible for a refund or owe the CRA.

Consequences of Late GST/HST Return Filing

The CRA imposes penalties for late filing, with specific penalties for failing to respond to a filing demand or submitting incorrect information. A $250 penalty is levied for neglecting to file in response to a filing demand.

Submission and Payment

Finally, after completing your return, transfer the relevant figures from section (a) (the working copy) to the official return form, and you are ready to submit your return. You can mail your GST/HST return to the provided address. The form also includes a four-digit access code for electronic filing.

To submit your return remotely, the CRA offers four methods: through your financial institution, using your computer (NETFILE), via phone (TELEFILE), or using third-party software certified by the CRA for GST/HST return filing such as TaxTron for WEb or EachTAx Free.

Remitting GST/HST Payments

Once you have submitted your return, it is essential to remit any outstanding balance. This can be done through your financial institution by adding the Federal account as a payee, similar to adding other electronic service providers. Under “Add a Payee,” look for “Federal – GST/HST Payment – GST-P (GST-P)” and transfer the owed amount electronically.

Alternatively, you can make payments online via CRA My Account, in person at a financial institution or Canada Post outlet, or by mail. The CRA provides a comprehensive list of available options for remitting your GST/HST.

At Ontario Business Central as part of your registration or incorporation process, we offer the ability to set up your HST account with CRA. You are not required to obtain a HST number until your business revenues exceed $30,000.00. At any point, you can set up the account if the business revenues are below the threshold; however in setting up the HST account, revenue Canada will be anticipating at minimum a yearly HST tax filing from you.

We hope this information has assisted you in understanding the HST tax form submission better. It is always recommended that you speak to a tax professional to ensure you are filing accurately and on time.

If we can assist you further, please feel free to reach out to us.

inquiries@ontariobusinesscentral.ca

Toll-Free: 1-888-934-0447

Local: 1-416-599-9009

Fax: 1-866-294-4363

Office Hours: 9:00am – 5:00pm

Monday – Friday E.S.T.

Ontario Business Central Inc. is not a law firm and cannot provide a legal opinion or advice. This information is to assist you in understanding the requirements of registration within the chosen jurisdiction. It is always recommended, when you have legal or accounting questions, that you speak to a qualified professional.