Totally Impressed with the service I received. The process was swift and registration completed in a few working days. No wonder the ratings are so high on Google. Keep up the great work.

This form allows for filing the Ontario Annual Return which is now required once a year.

This applies to either Profit or Non-Profit Corporations.

At the same time you can update any address or director information.

Keeping your Ontario Corporation up-to-date is very important! We can help you today!!

Filling your Annual Return in Ontario is simple with the help of Ontario Business Central. We make it easy to update your corporation quickly. It only takes a few simple steps to complete your Annual Return using our online form above.

Yes, to maintain compliance with the province of Ontario, you must file the Annual Return and if the annual return is not completed, the province can cancel the corporation for non-compliance.

The Annual Return is required within six months of the corporation's fiscal year end. This date is often determined by either the directors of the corporation or by the tax specialist overseeing the corporate tax filings.

No, historically you had to provide an update to your Ontario record by filing the annual return information along with the T2 corporation income tax return. Now, the filing is submitted directly to the province, separate from the tax return filings.

donald wingell

Totally Impressed with the service I received. The process was swift and registration completed in a few working days. No wonder the ratings are so high on Google. Keep up the great work.

Kelly White

It was very easy to renew my business license online. An agent followed up with me immediately by email when she noticed an address discrepancy on my application. It was easily resolved. Prompt, professional and friendly service.

Gazelle Ghajar

Awesome company to work with. Website is easy to navigate into finding what you need, online forms are simple to fill in, and the request was processed and confirmed within the afternoon! Very impressed with their service and will be using again for my husband's business come January.

As of May 15, 2021, there has been a change to Annual Filings under the Ontario Business Corporations Act (OBCA) for every Ontario Incorporation (both Profit and Not For Profit), Ontario Amalgamations, and Filings, where an existing corporation has either continued in Ontario or has registered as an Ontario Extra Provincial Licence.

Historically, the corporation would file an Annual Return as part of the corporate tax return filing each year through the Canada Revenue Agency. This requirement has been terminated by the federal government and in its place, the Annual Return is to be filed with the Province of Ontario.

This provides the opportunity for the corporate records listed with The Ministry of Government And Consumer Services (MGCS) to be up-to-date each year starting October 18, 2021.

The Annual Return in Ontario is to be filed on the anniversary of the date the entity established in Ontario.

The information required is as follows:

If the business has any new information including the registered office address, change in directors either adding, removing, ceasing or modifying, these details can be updated when filing the Annual Return.

If the corporate details remain the same, you can simply select that there are no changes and skip to the Name of Person Authorizing the filing.

Annual Return - There are no changes to the corporate address, directors or officers information

This provides the ability to by-pass any information requirements when there are no changes to the corporation from what was previously reported and filed through either a previous Annual Return or Notice of Change.

If the corporate address or any information related to the individual directors or officers has changed since the last filing, you will be required to update the information that has changed.

Any information that remains the same does not require any interaction on your part.

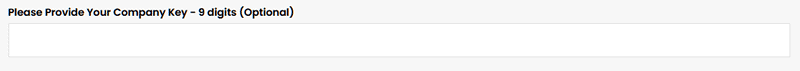

The Company Key was introduced in Ontario on October 19, 2021 and is a 9 digit number exclusive to your entity. Unless you have incorporated, amalgamated, continued into Ontario or have completed an Extra Provincial Licence after October 19, 2021, you will not receive the company key without requesting it directly from the Province of Ontario.

If your corporate address is not up to date, you can file a Notice of Change to update this record before applying. The corporate address for your corporation must be up to date as when the company key is requested, the code is mailed to the corporate address on file.

You may also carry on with your Annual Return filing without the requirement of the Company Key if you wish.

However, if you would like to obtain it, ensure your corporate address is current. You can apply with the Province directly to obtain your Company Key.

If you have already obtained your 9 digit code, you simply provide the number as part of your application submission.

Certain entities including Ontario Business Central who have been provided an Intermediary status with the Province of Ontario, can submit requests for the Annual Returns with or without the Company Key.

We might require the company key for a corporation in certain situations prior to submission with the province of Ontario. For instance, a company key is obligatory when all existing directors are being removed and replaced by entirely new directors. A secondary example is when the authorizing person is a third party but does not appear to be a lawyer or accountant. This is to protect the corporate entity from fraudulent transactions. If the requirement of the company key prior to submission of the annual return, it is available quickly and easily by completing the Business Verification Company Key on our website.

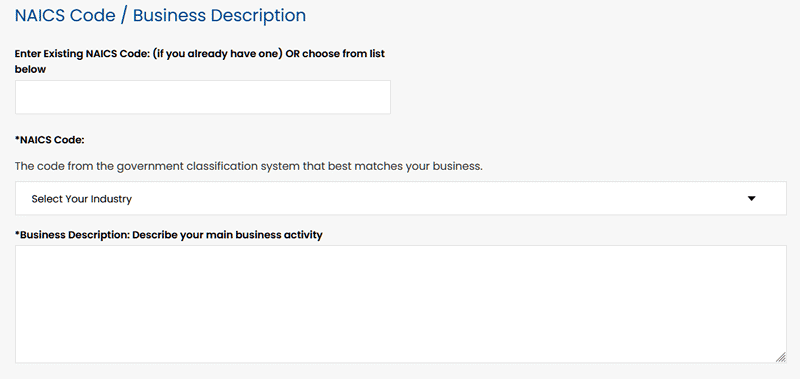

The North American Industry Classification System (NAICS) is a new system introduced in Ontario as of October 19, 2021. Previously, businesses were able to provide their own wording related to the business activity or description. The NAICS codes bring clarity and commonality to the different industries or business types across Ontario. This coding is in partnership with many jurisdictions throughout Canada, United States and Mexico.

This may sound complicated but it is actually fairly simple. We provide a listing of business industries or activities that you can scroll through to find listed business activity that matches your specific business. When you find a match,, you simply click on it to update.

Sometimes there is a further layering or determination that is required beyond what you have provided and we may email you a more specific listing to select from.

Once your industry has been determined, there will be a 6 digit code that you can use any time you are requested to provide your NAICS Code moving forward. If you have already established your NAICS code in a previous filing, you simply provide the 6 digits and move forward with the application.

The Province of Ontario, like all jurisdictions that have the Annual Return requirement, takes the deficiency very seriously.

Failing to file a required Annual Return could lead to the corporation being cancelled for non-compliance by the Province of Ontario. It is very important as you celebrate another year of accomplishment with your business, that you take a few minutes to file the mandatory Annual Return in Ontario.

When your filing has been completed, Ontario Business Central will maintain a copy and if requested, send a secondary copy to the Official Email address as provided in the application.

We will also send a reminder email notification of your Annual Return requirement each year as a friendly reminder on the anniversary of your business.

Other services offered by Ontario Business Central include Nuans Search and Report and Registered Business Services and more.